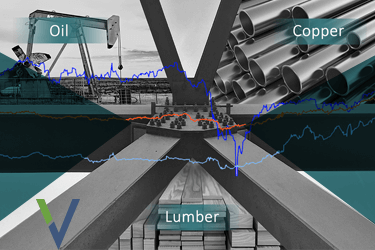

Economic uncertainty and disruptive change are causing more concern and volatility in an already turbulent construction industry. Since 2020, construction costs have increased by 40% on average in the United States

Fiscal Watch

Wael Yaeesh

November 14, 2022

November 14, 2022

You’ve probably heard the expression “fiscal measures” used repeatedly on the news lately. But what is it and how does it affect our industry? Simply put, a fiscal measure is when the government spends money and implements tax policies with the purpose of influencing economic conditions.

This information was originally presented at our June 2021 forum and is relevant today with the ongoing increase in interest rates. In this report we explain the history of the Federal Reserve, the new strategy for implementing monetary policy, and compare previous projections for construction costs to current bid prices.

Market Outlook Fed Watch

Richard Vermeulen

February 14, 2022

February 14, 2022

The Federal Reserve has reached another turning point in its history. The unprecedented monetary and fiscal stimulus injected into the economy at the onset of the pandemic has had a rapid effect on financial markets, successfully preventing a sudden recession and hardship in the economy.

The unprecedented monetary and fiscal stimulus injected into the economy at the onset of the pandemic has had a rapid effect on financial markets, successfully preventing a sudden recession and hardship in the economy.

If you're a Heating Ventilation and Air Conditioning engineer, you probably know a lot about Delta Ts, air contaminant concentrations, and so on. However, you might not know a whole lot about paleoclimatology.

Total Benefit - HVAC

Richard Vermeulen

June 20, 2021

June 20, 2021

If you're a Heating Ventilation and Air Conditioning engineer, you probably know a lot about Delta Ts, air contaminant concentrations, and so on. However, you might not know a whole lot about paleoclimatology.

Mini Construction Market Outlook Update

Melissa Chabot

March 18, 2021

Like the overall economy over the past year, the construction market has been in a state of flux. We thought it would be helpful to provide a quick market update prior to the release of our Q1 2021 Market Outlook report, which will be issued in the upcoming months.