Fiscal Watch: Understanding Fiscal Measures and the Impact of the Inflation and Infrastructure Acts on Construction Volume

November 14, 2022

Recent Blogs

- Market Outlook Fed Watch Part 2

- Market Outlook Fed Watch

- Steel Industry Volatility, Risks & Risk Mitigation

- Total Benefit - HVAC

- The Ins and Outs of Insulated Concrete Forms

- Mini Construction Market Update

- Where Did All the Wood Go

- How Do You Price an Elephant

- The Pitfalls of Dollar per Square Foot Estimating

- What if This is the Recession?

Fiscal Measures

You’ve probably heard the expression “fiscal measures” used repeatedly on the news lately. But what is it and how does it affect our industry? Simply put, a fiscal measure is when the government spends money and implements tax policies with the purpose of influencing economic conditions. Fiscal measures have played a significant role through the pandemic cycle. With talk of a looming recession, it is time to look at the interplay of growth, fiscal, and monetary measures that have taken over the past 30 months.

Let’s try to get a sense of the magnitude of these spending initiatives. Another way we can look at federal spending is that it is predominantly income transfer mandates. It would be better to say that the term spending only applies to discretionary outlays, not pertaining to defense spending, for example. The yearly non-defense discretionary spending of $900 billion (4% of GDP) is about equal to half the size of annual construction in the United States.

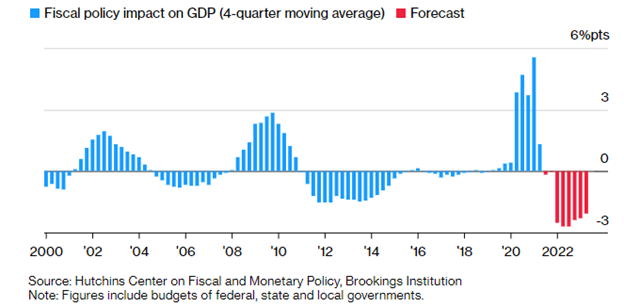

Recently, federal transfers alone lowered growth by 3.1 percentage points. A rise in federal and state tax collections and declines in real federal, state, and local purchases further contributed to the decline in fiscal impact, lowering GDP growth by 1.2 and 0.6 percentage points, respectively.

So, in total, fiscal policy reduced U.S. GDP growth by 4.9 percentage points at an annual rate in the second quarter of 2022. This caused GDP to fall at an annual rate of 0.6% in the second quarter. Fiscal impacts turned negative in the second quarter of 2021 as fiscal support waned and is expected to remain negative through the second quarter of 2024.

Additionally, reduced spending accompanied the pandemic through shutdowns of entire sectors of the economy. Now, the buildup of personal savings combined with negative real interest rates and short supply is what caused the burst in inflation. We saw a similar effect to asset prices, like our homes, or our investment portfolios.

I would argue that it is not a real recession if real GDP is not negative.

Legislation

Here is a quick summary of how we anticipate The Infrastructure Act and Inflation Reduction Act will impact our industry in the coming years.

The Inflation Reduction Act will redirect about $500 billion into new spending categories including construction. It intends to reduce prices directly through subsidies and price caps. Only 30% of the Inflation Reduction Act’s $500 billion will be allocated to construction. Adjusted for annual de-escalation, it will provide $10 billion USD per year.

The Infrastructure Act introduces new spending categories which total $550 billion in infrastructure spending. Unlike the Inflation Act, 80% of the Infrastructure Act’s $550 billion will go towards construction. Adjusted for de-escalation, that is $30 billion per year.

Combined, both acts could contribute to the annual construction volume. According to our calculations, $40 billion (annual legislated spending) / $1.75 trillion (put in place construction) yields a 2.3% total increase to annual construction put in place, mostly in Non-Residential and Infrastructure over the next 8 to 10 years.

Government Deficits

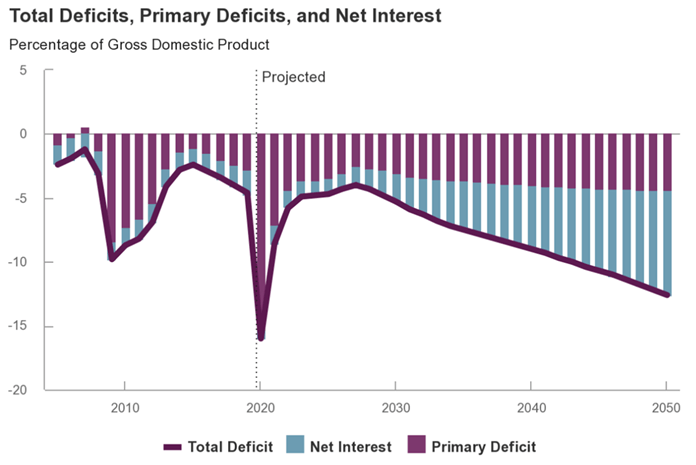

Federal government deficits are really a code word for money creation. When the central bank buys a bond they create savings in federal accounts, also known as National Debt. After increasing rapidly with the pandemic, total deficits are now decreasing over the short term and stabilizing over the medium term. The Congressional Budget Office’s most recent projections show the cumulative deficit from 2021 through 2030 totals nearly $13 trillion. Borrowing to finance that deficit—at a time when interest rates are expected to rise—would cause net interest payments as a percentage of GDP to increase over that period, from 1.4% to 2.2%. However, this is generally in line with the 50-year average of 2.0%. History shows that deficits were too

In conclusion, macroeconomic budgets must run in deficit over the long term to support economic growth and positive inflation targets. For example, if we are targeting 3% growth in Gross Domestic Product and 2% increase in prices, that means long term deficits of 5% of GDP are required to create the money supply for this expansion.