Recent Blogs

- The Feds New Normal

- Market Outlook Fed Watch Part 2

- Market Outlook Fed Watch

- The Bipartisan Infrastructure Plan and Construction Costs

- Total Benefit - HVAC

- The Ins and Outs of Insulated Concrete Forms

- Mini Construction Market Update

- Where Did All the Wood Go

- What if This is the Recession?

- How Do You Price an Elephant

Steel Increases, Volatility

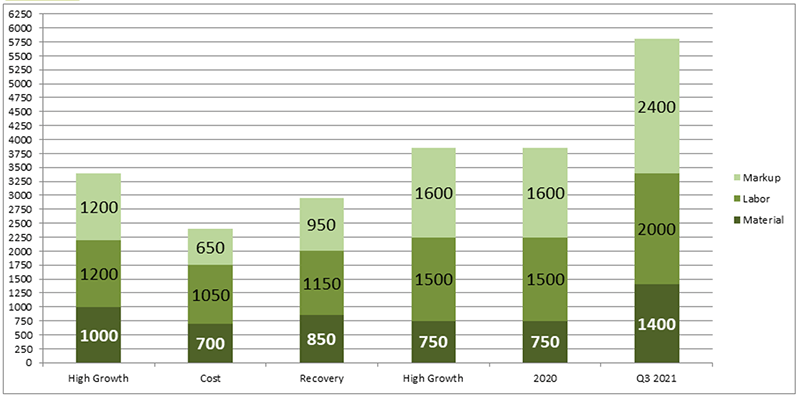

The cost of structural steel has been volatile across the United States with steel supply pricing sharply increasing since March 2020. We have gone almost a decade without being dramatically impacted by increases in steel commodities; arguably this was only a matter of time.

At the beginning of the pandemic-driven shutdown, many steel mills halted production citing fears of a prolonged recession and possible depression. Unanticipated changes in consumer demand for steel-related products increased during the COVID-19 lockdown. However, furnaces were idle long after demand started to increase triggering a supply shortage. With Covid-19 vaccines readily available world governments have relaxed lockdown protocols and economies have been firing up. The lockdown applied breaks are coming off the pandemic-driven economic shutdown.

The construction industry is the largest consumer of steel, accounting for 50% of total world steel consumption, followed by the transportation sector (16%), the machinery sector (14%) and metal products (14%). All these steel-intensive industries are coming back online and demanding steel product to meet demand. Construction projects that were put on hold are starting to reactivate and as businesses and consumers return to “business as usual” we can expect that industry demand of steel will only increase.

Other Market Factors Affecting Steel Prices

The American steel industry is controlled by two major players, Cleveland-Cliffs (via major steel mill acquisition) and United States Steel Corporation. There is an inventory problem in the US that is controlled by these two major players.

The automotive global chip shortage which is currently slowing down new car production will eventually be resolved. This will allow the automotive industry to ramp up production and lead to more domestic steel demand which could have a large impact on an already stressed market.

As building construction ramps up other factors that can drive structural steel pricing include open shop versus union sub-contracts, perimeter detailing, type of finish (unprimed, AESS, galvanized) and proportion of tube steel versus regular beams. Additionally, there can still be variability in pricing due to project-specific logistics such as larger spans (read: the driver for a larger crane size), the particulars of the crane rental (location, reach, etc.) and total tonnage on a project, and the accompanying economies of scale.

FOB mill

Hot Rolled Ban

Cold Rolled Coil Steel

Plate Steel

$/ton

591

767

679

$/ton

951

999

840

$/ton

1,819

2,033

1,559

Source: www.steelbenchmarker.com

Structural Steel Pricing – Source: Vermeulens

Project Cost Mitigation

- ensure contracts have an automatic price adjustment clause to take advantage of future market corrections. Anticipated furnace restarts and increasing imports should help to alleviate inventory issues

- repetitious design wherever possible to optimize productive fabrication and erection of steel members

- factoring in longer than usual lead times for standard shapes and more for atypical pieces

- the current bump in pricing should be relatively short-lived; is it worth waiting for steel to come down/level off only to have the remainder of the project escalate in cost? Or ensure steel contracts include pricing adjustment clauses

- as design evolves, allocating the design and escalation contingencies that would have otherwise been removed from the costs and parking them in a bidding contingency bucket if the project is bidding in the next 6 months

- consider a design-assist package for steel to gather insight from the subcontractors on the best way to keep costs low

- consider significant add alternates to mitigate pricing volatility

- engage a third-party estimator (such as Vermeulens) to ensure quoted rates are aligned with current market conditions

Rivlyn Manning

Principal

Rivlyn has been in the industry for over 3 decades. Drawing upon his history background, he enjoys working on cultural and socially significant projects.

Zachary Bergeron

Principal

Zachary has been in the industry for over 2 decades. He is interested in the company’s more complex and challenging projects.