Market Outlook Quarterly Q4 2023

Vermeulens’ Market Reports are based on actual bid prices in the Nonresidential Construction Industry. Forecasts are based on leading indicators and historical comparative analysis.

- Fed Funds Rate: rate increases have halted; however, rate cuts are not currently on the agenda until there is further confidence of a “soft landing”

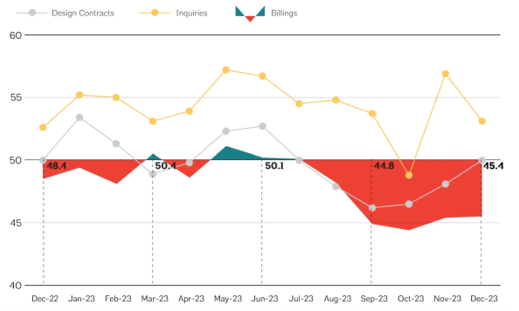

- Architectural Billings: 14 consecutive months of declines may indicate slowing in future construction volume. Q4 showed substantial declines. ‘Firms are increasingly concerned about managing the costs of their firm in 2024

- Employment: Q4 job growth averaged 165,000 jobs per month, growth rate has slowed by 25% relative to Q3

- Construction Dollar Volume:

- nonresidential construction increased by 2.1% in Q4 and 20.7% year-over-year. However, Manufacturing has grown by 60% year-over-year. Nonresidential, excluding Manufacturing, was up by less than 1% in Q4

- residential construction increased 7% in Q4

- infrastructure spending increased 0% in Q4 and 19% year-over-year

- Construction Jobs: 50,000 construction jobs were added in Q4; currently 9% above pre-pandemic levels. Based on dollar volume changes, the majority of the construction jobs were in residential, infrastructure, and manufacturing construction

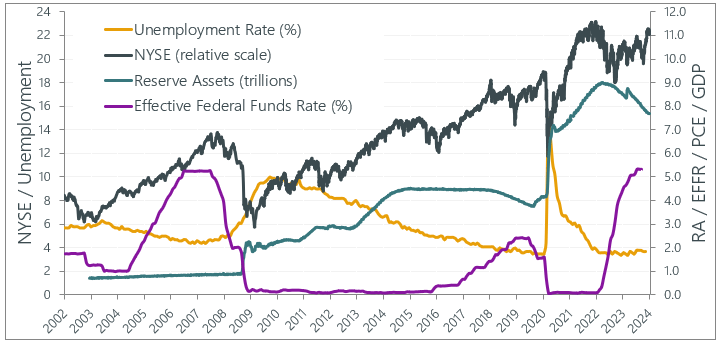

- New York Stock Exchange: 10.9% increase year-over-year but generally just returning from a brief downturn at the beginning of quantitative tightening. Uncertainty has moved the stock market sideways for the last 2 - 2.5 years

- GDP: growth for Q4 2023 was 24%

- Commodity prices continue to decline to long term averages and buying power is returning in the steel market

- Vermeulens Index: Nonresidential Construction Prices increased at a rate of 5% per month in Q4

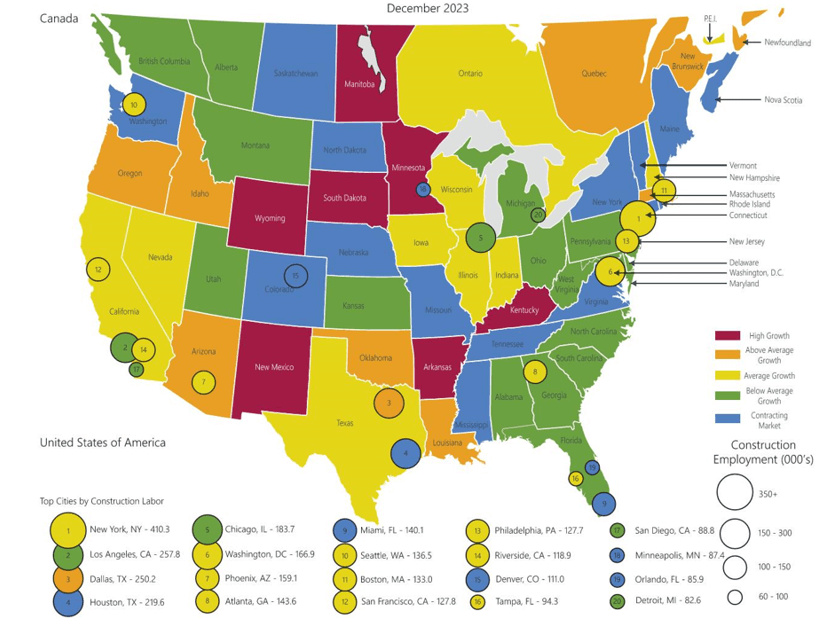

- Volatility Declining: we are recommending a reduction or elimination of bidding contingency in some markets

- Price Inflation: short term construction costs are forecasted to be 4% - 6% for 2024

Fed Watch

Inflation and Employment Targets propel monetary policy, and subsequently construction prices. Ongoing increases of interest rates to 5.3% along with $1 trillion quantitative tightening, has caused a decline in interest rate sensitive sectors such as residential construction. Unemployment remains at historic lows.

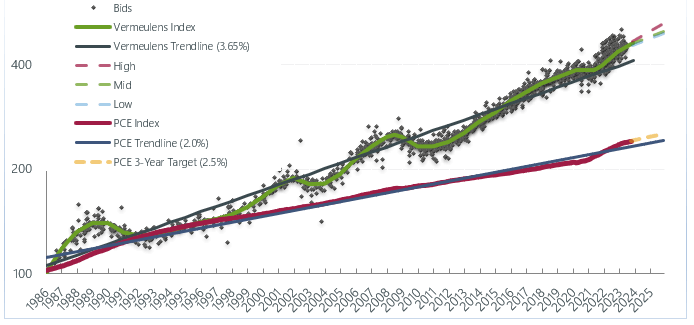

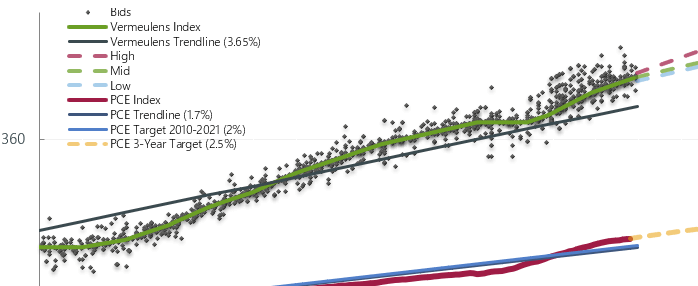

Vermeulens Construction Cost Index

Nonresidential construction prices for Q4 2023 nationally increased 0.5% monthly as contractor backlogs filled, and labor/material shortages continued.

Bid prices for nonresidential construction projects are shown relative to the average represented by Vermeulens Trendline. Personal consumption prices are tracked relative to PCE Trendline and PCE Target.

AIA Billings

Architectural Billings are a leading indicator for future construction volume. A score greater than 50 indicates growth. Design fee billings typically indicate construction volume 9 - 12 months in advance. Architectural Billings have been declining or near declining for 14 consecutive months.

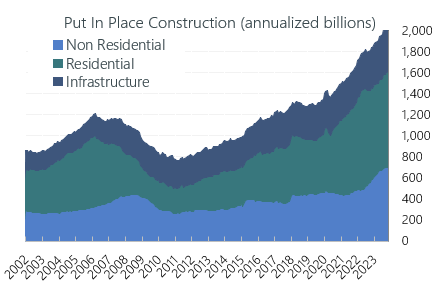

Put In Place Construction

Construction dollar volume is the main driver of construction prices.

Total volume grew by 3.9% in Q4, posting a 13.9% year over year increase (December 22/December 23).

Residential dollar volume increased 4.7% in Q4, increasing year over year by 6.8% (December 22/ December 23).

Nonresidential spending is up 20.7% year over year (December 22/ December 23). Leading the way is manufacturing with Nonresidential reaming flat in Q4 without the support of Manufacturing.

Infrastructure spending increased 5.0% in Q4 2023, with an 20.7% year over year increase (December 22/ December 23). Government spending on Infrastructure is expected to continue.

http://www.census.gov/construction/c30/c30index.html

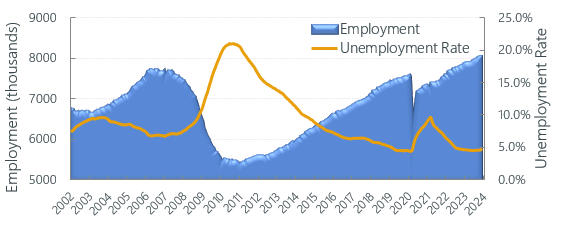

Construction Labor Market

Construction Unemployment at the end of Q4 sits at 4.6% (12-month average), up from 4.6% at the end of Q3 2023, reflecting lower growth in total construction dollar volume.

Construction Labor Force Growth Rate

Construction Labor Force Growth Rate is calculated by the current 12-month average in construction employment relative to previous 12-month average in construction employment

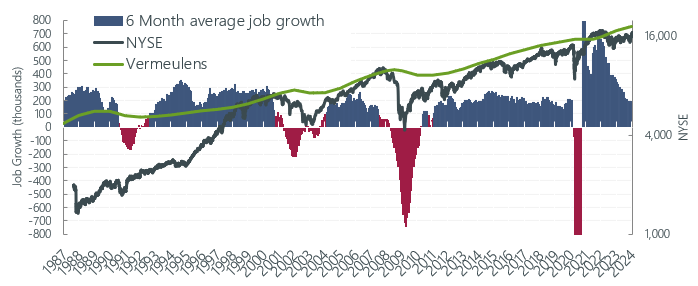

Total Jobs and Market Performance

Monthly Average Job Growth for the US economy through Q4 was 165K peaking in December at 216K.

The chart below removes short-term fluctuations in job growth by looking at a 6-month moving average. The size of the labor force grows at 100,000 per month due to population increase. Sustained periods of recession, where job creation remains below 100,000 jobs per month, have accompanied dips in construction prices as illustrated by the red bars below.

https://data.bls.gov/timeseries/CES0000000001

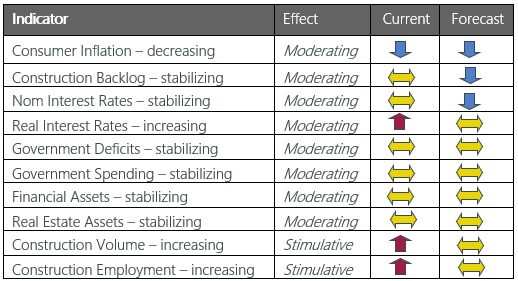

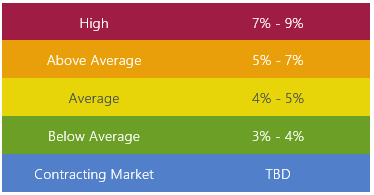

Forecast - National Trend

Nonresidential Construction prices continued to rise in 2023 at 0.5% per month as they did through 2022. Contractor backlogs, strong margins, increased labor costs, and volatility in supply prices contributed to these rates. As volume growth slows and monetary conditions tighten our forecast is 4 - 6% for 2024 settling to a long-term average of 4%. This aligns with Federal Reserve estimates for inflation of 5.6% for 2022, 3.6% for 2023, 2.5% in 2024, and 2.1% in 2025.

“Our policy rate is likely at its peak, if the economy evolves broadly as expected it will likely be appropriate to begin dialing back policy restraint at some point this year” Federal Reserve Chair

For related content please visit our affiliate, Green At No Cost

If you:

Need any help with your projects,

Want to set up a presentation to your group,

Would like to meet to see how we can help your team, and expand our business together,

Are looking for company information,

Please contact: Marisol Serrao, Principal, at 617 263 8879 or mserrao@vermeulens.com.