Market Outlook Quarterly Q2 2024

Vermeulens’ Market Reports are based on actual bid prices in the Nonresidential Construction Industry. Forecasts are based on leading indicators and historical comparative analysis.

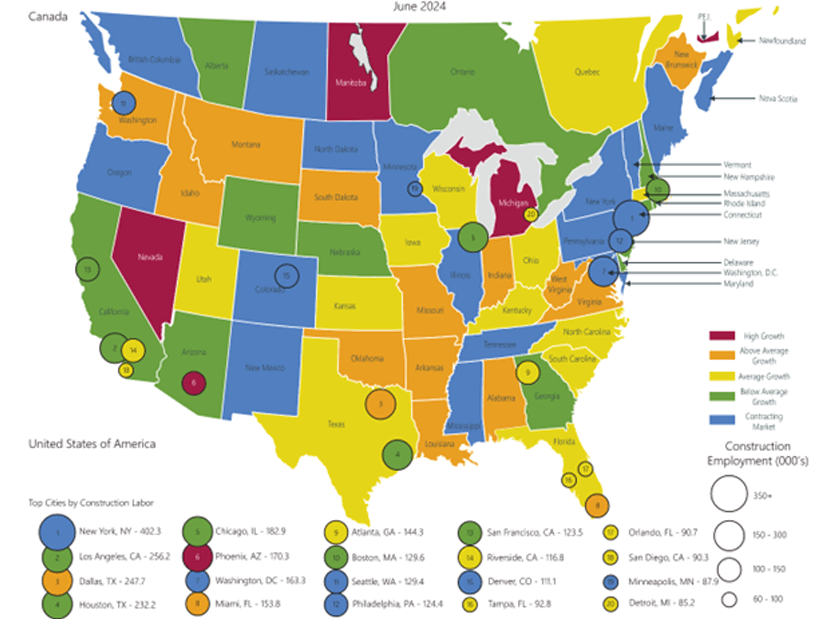

- 58,000 construction jobs were added in Q2, 8.4% above pre-pandemic levels. Dollar volume changes in Q2 indicate many of these were added in the manufacturing sector (+23.52%) while office, commercial, healthcare, and educational spending decreased

- Commodity prices continue to decline to long-term averages and buying power is returning in the copper and steel markets

- Volatility Declining: we are recommending a reduction or elimination of bidding contingency in some markets

Forecast - National Trend

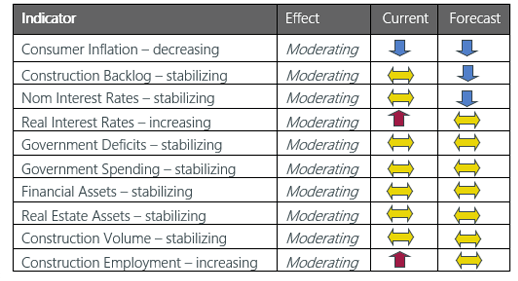

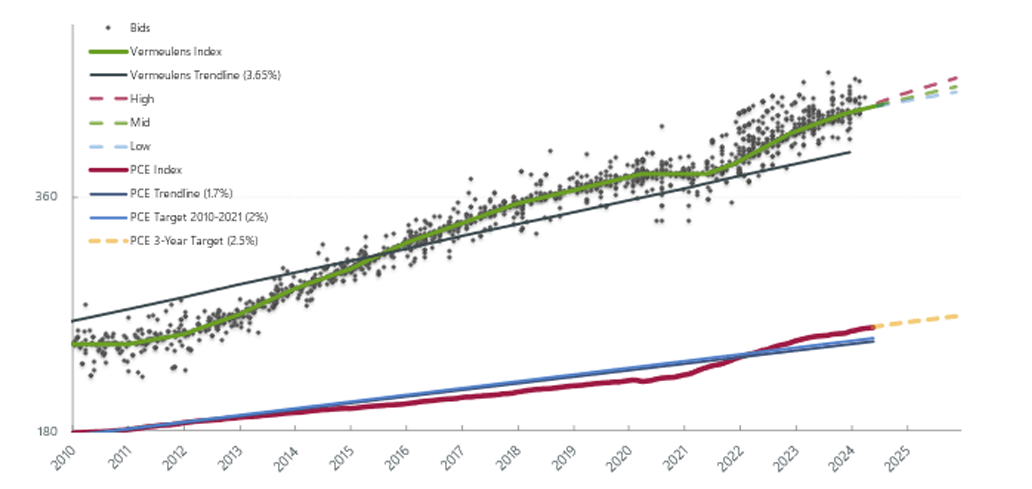

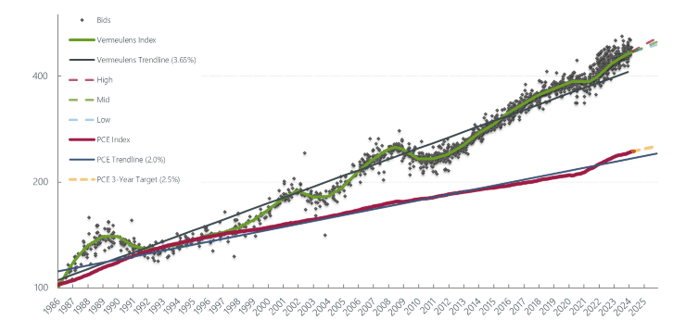

Nonresidential Construction prices continued to rise in 2024 at 0.5% per month. As monetary conditions remain tight our forecast is 4 - 6% for 2024 settling to a long-term average of 4%. This aligns with Federal Reserve estimates for inflation of 5.6% for 2022, 3.6% for 2023, 2.5% in 2024, and 2.1% in 2025.

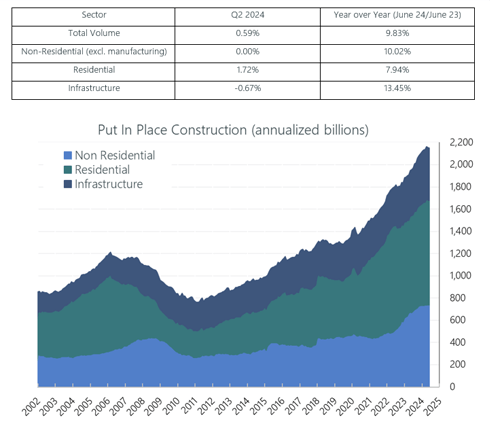

Put In Place Construction

Construction dollar volume is the main driver of construction prices. Total volume went up by 0.59% in Q2, and 9.8% annually (June 23/June 24). This represents a rapid deceleration of growth: 3.5%/quarter average in 2023 down to 0.59% in Q2 2024.

http://www.census.gov/construction/c30/c30index.html

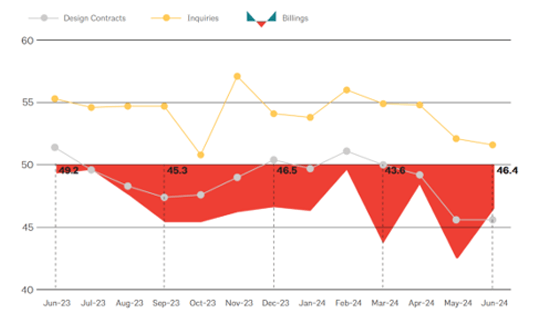

AIA Billings

Architectural Billings indicate slowing in future construction volume. Architectural Billings have been declining for 17 consecutive months. Poor indicators of future work accompanied by the smallest average backlog in the past 3 years are mitigated only by industry optimism in declining interest rates. A score greater than 50 indicates growth.

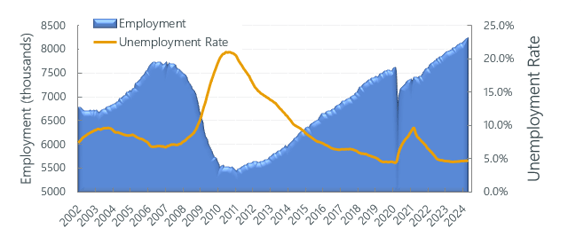

Construction Labor Market

Construction Unemployment in Q2 remains steady at 4.7% (12-month average), reflecting a slight increase but overall remaining low.

Construction Labor Force Growth Rate

Construction Labor Force Growth Rate is calculated by the current 12-month average in construction employment relative to previous 12-month average in construction employment.

Vermeulens Construction Cost Index

Bid prices for nonresidential construction projects are shown relative to the average represented by Vermeulens Trendline. Personal consumption prices are tracked relative to PCE Trendline and PCE Target.

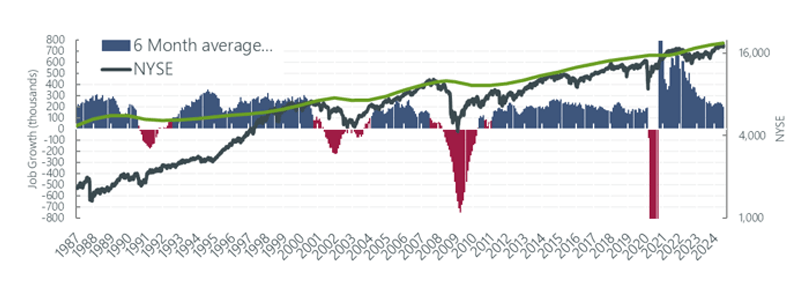

Total Jobs and Market Performance

Monthly Average Job Growth for the US economy through Q2 was 170,000/month.The size of the labor force grows at a rate of 100,000 per month due to population increase. Sustained periods of recession, where job creation remains below 100,000 jobs per month, have accompanied dips in construction prices as illustrated by the red bars below.

https://data.bls.gov/timeseries/CES0000000001

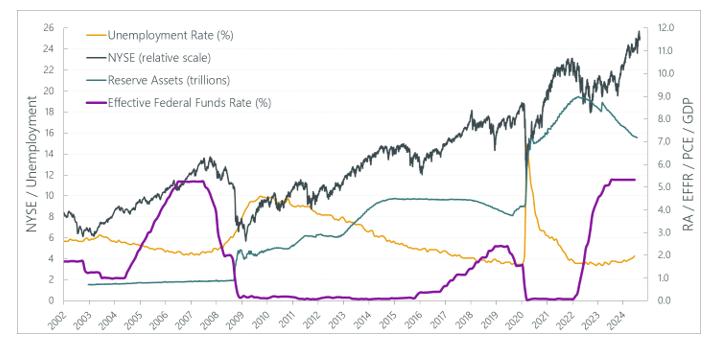

Fed Watch

Inflation and Employment Targets propel monetary policy, and subsequently construction prices. Inflation has continued its downward trend since the beginning of the year, though remaining high overall. Along with $1 trillion quantitative tightening, growth has slowed in interest rate sensitive sectors such as residential construction. Unemployment remains at historic lows.

“…the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent…. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” – FOMC July 31, 2024, statement

New York Stock Exchange: increased 13.90% year-over-year economic uncertainty has held the stock market to minimal increases since January of 2024. Q2 GDP had an annualized growth rate of 3%.